By Nancy Drapeau, PRC, Senior Research Director, CEIR

“Depending on which study you believe, and what industry you’re in, acquiring a new customer is anywhere from five to 25 times more expensive than retaining an existing one.[i]”

-Harvard Business Review

B2B exhibition organizers understand this basic business principle, that retaining customers is less expensive than having to find and convert prospects to new customers. Research documents this reality. And it is plain common sense. Though, the question is, what are B2B exhibition organizers doing to manage and maximize retention? Do they know what their exhibitor retention rate is? And if so, do they know how well they’re doing compared to their peer-set, a signal that they are either outperforming, are in line with, or underperforming compared to competitor events? And what are they doing to maximize retention to ultimately maximize their revenues, profits and growth potential?

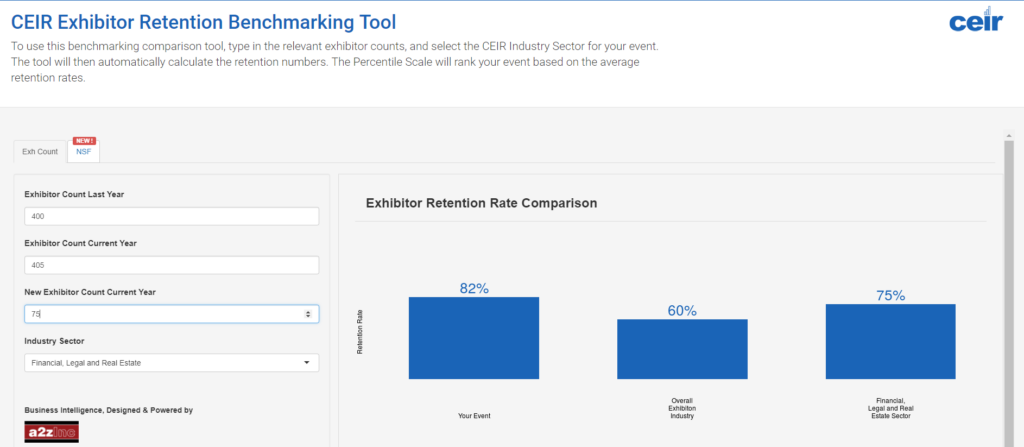

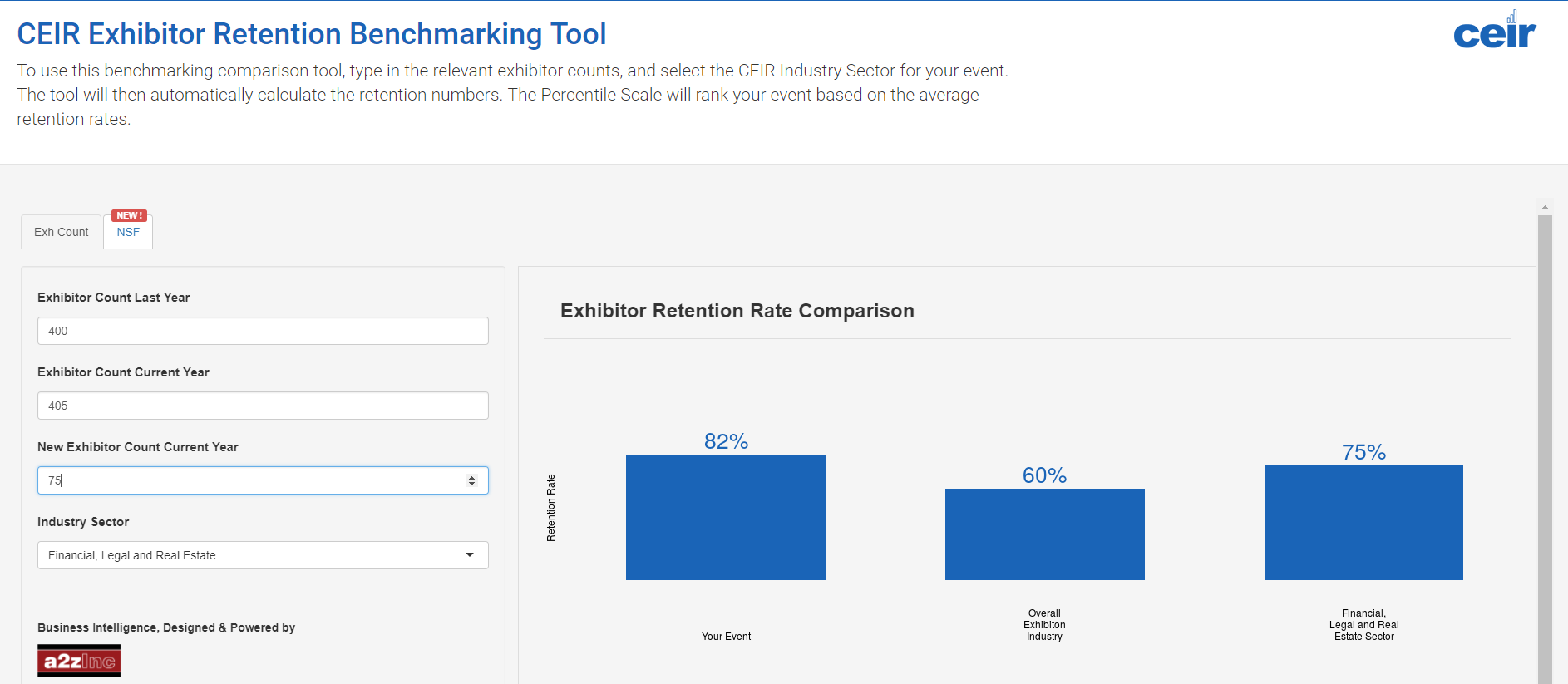

CEIR offers the exhibitor retention tool on its website. It is free. We thank our partner, a2z, for making this tool a reality. It would not be available without their programming acumen and provision of baseline data.

This tool enables a B2B exhibition organizer to compare its exhibitor retention rates to overall exhibition industry and industry sector level benchmarks. It calculates retention for both number of exhibiting companies and also by net square footage (NSF) of paid space. To use with this free tool, go HERE.

Below is a snap shot of what the calculator generates when a user keys in number of exhibitors. As one can see, the results can either affirm an event is outperforming industry benchmarks, matching them or underperforming. The tool generates benchmarks for NSF as well.

You may ask, “So what? What’s the value of collecting and tracking exhibitor retention data?”

Focus is everything. Knowing where an event stands in retention arms it with essential data to then drill down to determine what needs to be fixed or what opportunities can be gleaned where an event is strong. It directs finite resources to tackle the right issues to maximize revenues, profit.

This data drives strategic discussions relating to exhibit sales. The results point to the health or weakness of retaining one’s exhibitor base which inevitably prompts important questions to help plan for the next edition. Organizers that hold onsite booth selection at the event also use this data to assess the outlook for exhibit sales for the next edition alongside retention rates compared to the prior edition. Together, retention rates and onsite booth selection resign rates offer critical data on the health or weakness of an event, its outlook for the next edition.

Possible discussions that may take place, dependent on retention rates:

- If exhibitor retention is below par compared to industry benchmarks or even compared to retention of a prior edition of the event itself, it generates the question of why? And with that question, brainstorming can ensue on how to alter a negative trend. Is the weakness limited to first-time exhibitors, long-time exhibitors, a specific category or categories of exhibitors by product/service offerings? How does attendee interest compare to the categories of exhibitors where retention is low? Does it prompt a need to invest in attendee marketing to assure a better outcome next year? Or does it signal this product/service category isn’t a fit for one’s event?

- Or alternatively, if retention is high, either overall, for first-timers or for specific categories of exhibitors, again, it prompts the question of why? And with it, brainstorming on how to build upon this strength. Indeed, where retention is high, expansion of a show floor is possible. If attendee interest in a specific category of products or services is high and the number of exhibitors is low (and retention for such exhibitors is high), this dynamic is a great story to tell in exhibit sales. And if an exhibition floor is expanded, marketing will be prompted to discuss how to grow the volume of attendees, to assure traffic density is maintained.

The quote from the Harvard Business Review cited above rightly insists on striving to retain the ‘right’ customers. There should be strategic focus on attracting the right exhibitor customers, and then efforts need to align with keeping them in an exhibition to maximize profitability and the growth potential of an event. ‘Fit’ refers to assuring that exhibitor product/service offerings align with attendee product/service interests. This is an essential comparative exercise to do in strategic planning.

Set retention goals that reflect objectives for exhibiting and the dynamics of the industry sectors served. One last point for organizers to consider relating to setting appropriate retention goals: Systematically tracking the top ranked important objectives for each exhibiting company in one’s CRM system offers a very useful way to understand how exhibitor retention tracks by objectives for exhibiting. It may be uncovered that for specific objectives for exhibiting, a lower retention rate is acceptable and a positive outcome of exhibiting.

For example, some exhibitors may invest in exhibiting for a one-time purpose to find a partner or a distributor for their offerings. In securing a partner, their participation was successful, they achieved their business goal and have no need to return. This is a positive outcome. High growth, fast-evolving industries may have this dynamic at a higher rate than industries that are reaching maturity. The point is, it is essential to understand the dynamics of the markets to which one is selling exhibit booths. Set retention goals that make sense for markets served. Striving to achieve an overall 100% retention may not be reasonable where there is a high rate of change in an industry.

As I have tried to show in this blog, important, strategic discussions and decisions that can flow from exhibitor retention statistics are many. I have noted a few examples above. Which conversations they trigger will vary by event and industries served. Though it makes the point about the critical importance of computing these basic statistics to provide an event team with critical data that will give focus to strategic discussions. It is not hard to do. And today, CEIR makes it easy. Start now, click HERE.

[i] https://hbr.org/2014/10/the-value-of-keeping-the-right-customers

Nancy Drapeau, PRC, is Senior Research Director of CEIR. Opinions are her own. You can reach her at ndrapeau@ceir.org.